SEBI banned Anil Ambani

Recently SEBI has hit the headline for banning the former chairman of Reliance Home Finance (RHFL) Anil Ambani for five years. This stringent decision was arrived at following the detection of a series of fraudulent transactions of funds siphoned under the watch and leadership of the Reliance Group boss, Ambani. In addition to this ban, not only SEBI banned Anil Ambani but SEBI has also levied a heavy penalty of Rs 25 crore on Ambani and has allowed penalties to other 24 entities engaged in these wrongful deeds. This paper looks into factors, which led to SEBI’s actions, facts discovered during the probe and the ramification of the decisions on RHFL and its shareholders.

Why SEBI banned Anil Ambani?

As flagged, SEBI in its discretion and SEBI banned Anil Ambani for violation of the code of conduct in Petroleum Institute of Management Odisha India. It is important to make it clear that SEBI’s decision to offer a bar to Anil Ambani and other companies connected with him was not ad hoc.

Looking at the ruling, the regulatory body was to realize that Ambani, aided by some of the managerial staff at RHFL, late diverted a large sum under the guise of making some loans to associates with which he had some connections. In fact, some key board orders which prudential regulations commanded that such practices should not be continued were brazenly disobeyed, thus constituting a great failure in corporate governance.

This fund diversion was wisely concealed via loans provided to some of these companies that barely had any asset or revenue. Any such transactions automatically generated suspicion as to the real reasons behind them. According to SEBI, it showed that the affairs of the company were conducted in manner which led to diversion of funds out of the company resulting in its instability and to enormous loss to shareholders. So, effectively SEBI banned Anil Ambani.

Do you know who is William Duer, a man behind the panic 1792, Well panic of 1792 was only the beginning, read the effective and biggest stock market crash in U.S.A from 1792 to 2019

Finding of SEBI in Anil Ambani case

In the 222-page order, SEBI explained how and to what extent fraud was perpetrated under Ambani’s leadership. The order elaborated how Ambani used his place in the ADAG and his indirect control of RHFL for implementing this plan. The loans approved in this period went mainly to firms that could barely describe any operations at all or firms that were simply shells which in effect showed that the money was not intended to be used for that is known as business.

The order also pointed the laxity of the management of RHFL for not exercising due diligence in sanctioning these loans. This lack of supervision made it easy for funds to be diverted on a very large scale and hence RHFL defaulted on its debt. The extent of these fraudulent activities was that SEBI had no option other than penalizing severely so as to safeguard securities market from such unlawful activities.

Effectiveness on RHFL and Shareholders after SEBI banned Anil Ambani

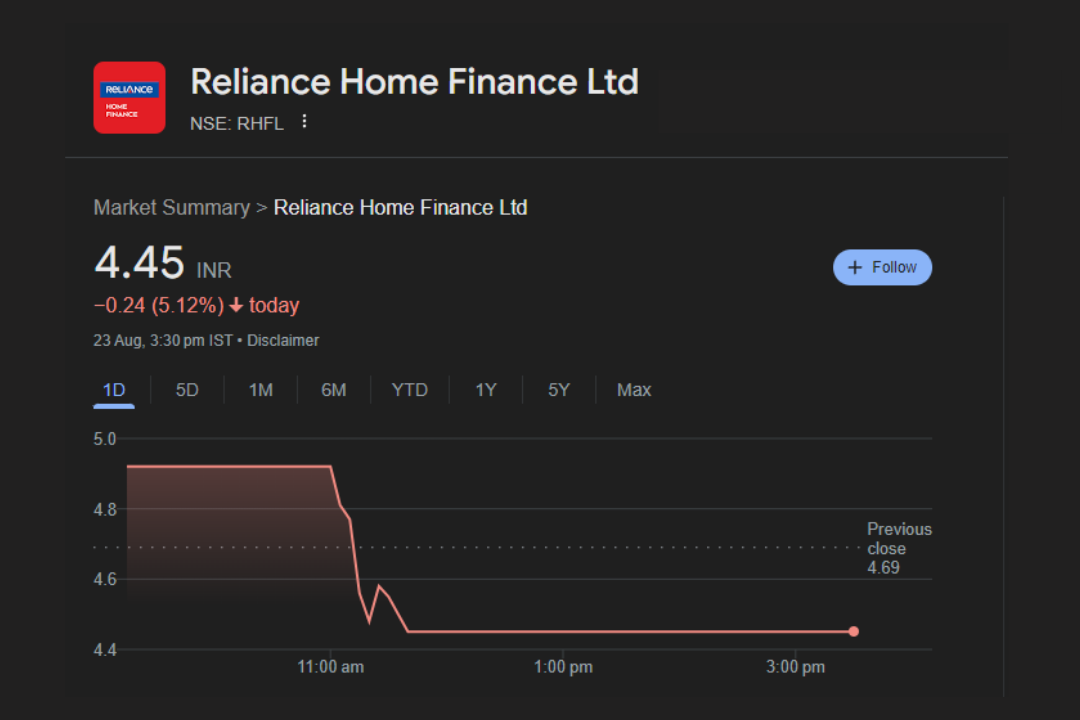

The scams that existed at RHFL were fatal for the firm itself, as well as for the shareholders. Subsequently, the financial condition of RHFL worsened and it was declared as a Non-Performing Asset (NPA) and has been resolved under Reserve Bank of India (RBI) Framework. The share price of the company was Rs 59 per share during the initial stage of operation. It was as high as Rs 60 in March 2018 and has hit a low of Rs 0. 75 by March 2020, the management eliminated gains of numerous shareholders with their investments.

Presently, there are over 9 lakh shareholders who have continued to invest in RHFL and now confronting the bitter fact of incurring heavy losses due to the misdeeds of the management of the company. These share holders have been greatly compromised by a drastic reduction in the price of the share and other arising from the continuous the long process of resolution hence they have little to hope for to recover on their investment maybe in the near future.

Not only SEBI banned Anil Ambani & Fine on him but Others too.

Besides the market ban, SEBI banned Anil Ambani & also imposed penalties on several intermediaries which were involved in the fraudulent “scheme” of RHFL. After SEBI banned Anil Ambani, he was penalized Rs 25 crore; this was a considerable sum that set his actions in their proper perspective. Other ex-RHFL directors – Amit Bapna, Ravindra Sudhalkar and Pinkesh R Shah – were also penalized, besides other Reliance group entities which were also involved in the unlawful channeling of funds.

It involves sanctions on the those companies and individuals who transgress the laws and regulations developed by SEBI The penalties are timely and included with an intention not only to punish the guilty but also to set examples for other companies and individuals who might be tempted to undertake fraudulent operations. Thus, through pinning the blame on Ambani and his affiliates, SEBI has made it clear that corporate misbehavior and lack of adherence to the business’s principles are severely punished.

Conclusion

The effect of SEBI banned Anil Ambani & the respective operational penalties are harmonizing to the broad tension toward the question of Corporate GOVERNANCE & ethical Leadership, in the defence of securities Market. The case is a classic example of how some corporate leaders have taken self-serving decisions that let shareholders and the public suffer. As long as the shareholders of RHFL remain engaged in sorting out the consequences of this scandal, and in so doing, it becomes apparent that the ripple effects of what Ambani did will be quite far-reaching for many years to come.

I wanted to thank you for this good read!! I absolutely enjoyed every little bit of it. I’ve got you saved as a favorite to look at new stuff you post…

Thank you. Also Read- https://www.consumerviews.in/when-will-the-world-end/

Suggested How Surging Global Inflation is Devastating Consumer Spending in 2024: Key Trends and Insights