Introduction

In this article, we will learn about all the stock market crashes since the commencement of the New York Stock Exchange. The first stock exchange started in 1970 and was named the Philadelphia Stock Exchange. Although the New York Stock Exchange was established on May 17, 1972, it is now the largest stock exchange in the world. We will not only know all the falls but also the size of the fall in percentage, the reason behind the fall, and the time it took to recover. So let’s begin to uncover all the falls of the U.S. stock market from history to the present.

What History Says

The first stock market crash was in 1972, and it took about three to four months to fully recover. So, let’s proceed to learn about the other 16 great volatile days or significant stock market crashes happening in the world.

Panic Of 1792 (Panic series stock market crash)

Fall Size: The fall size of “Panic of 1792” is unknown.

Causes: Tremendous speculation was shown in the government securities market. Too much overbuying happened, which led to over-inflation in government securities. William Duer misused inside data and took excessive borrowed funds, then defaulted, which created massive panic in the market. The availability of credit was gone because of a market panic. As there were fewer funds, people sold their holdings at a loss.

Recovery: Took few months.

Panic Of 1819

Fall Size: Unknown.

Causes: After the war in 1812, the U.S. economy was booming at a significantly higher rate, which led to overproduction, which led to a collapse in commodity prices. Then we see restrictive lending policies, which led to low money flow in the market and also many bank defaults.

Recovery: Took several years.

Panic Of 1837

Fall Size: Unknown.

Causes: The bank made over-speculations on various sectors and sanctioned massive loans, which created an unsustainable financial bubble. As a result of that, we saw a decline in cotton exports, which influenced restrictive lending policies along with a lack of liquidity around funds. Excessive inflation caused economic instability.

Recovery: Close to six years.

Panic Of 1857

Fall Size: Almost 66%

Causes: Overspeculations in railroad projects led to overvaluations and collapse, and then the Ohio Insurance Company failed because too much money was poured into railroad projects. European market slowdown, which impacted heavily U.S. exports. Because there were fewer buyers in the financial market, investors sold their holdings at losses, which led the stock market to plummet.

Recovery: This stock market crash took several years to recover.

Panic Of 1873

Fall Size: The reason is unknown for Stock market crash of 1873

Causes: Overfunding railroad projects was the main reason for the crash of 1873, the same thing that happened in 1857. Massive loan defaults caused speculation on the market, then there were bank failures at Jay Cooke & Company.

Recovery: Nearly 4 years.

Panic Of 1893

Fall Size: Stock market crash around 30–40%

Causes: Again, we have seen the same issues as before: the over-funding of railroads, which led to many bank failures. Another big problem was that the U.S. had a decline in the gold standard, which made investors panic. At this point, when the bank stopped lending, major layoffs started. Collapse in the agricultural market, which made prices go down.

Recovery: Several Years.

Panic Of 1907

Fall Size: 50%

Causes: United Copper Company defaulted, which led people in the market to panic, which led to bank runs (it is a situation when everyone comes to withdraw their money at the same time frame). Lack of liquidity flow from the central bank made the situation worse.

Recovery: 1-2 Years.

Now all those interesting stock market crash of are going to start…

Wall Street Crash of 1929 (Black Tuesday)

Fall Size: stock market crash of Almost 89%

Causes: People were investing with borrowed funds, which made the stock price touch the sky. Factories produced massive products more than they could sell, which caused significant layoffs and reductions in profit, which impacted the decline in consumer spending. Too many bank failures were seen, which worsened the people’s conviction in financial institutions.

Recovery: Took almost 25 years.

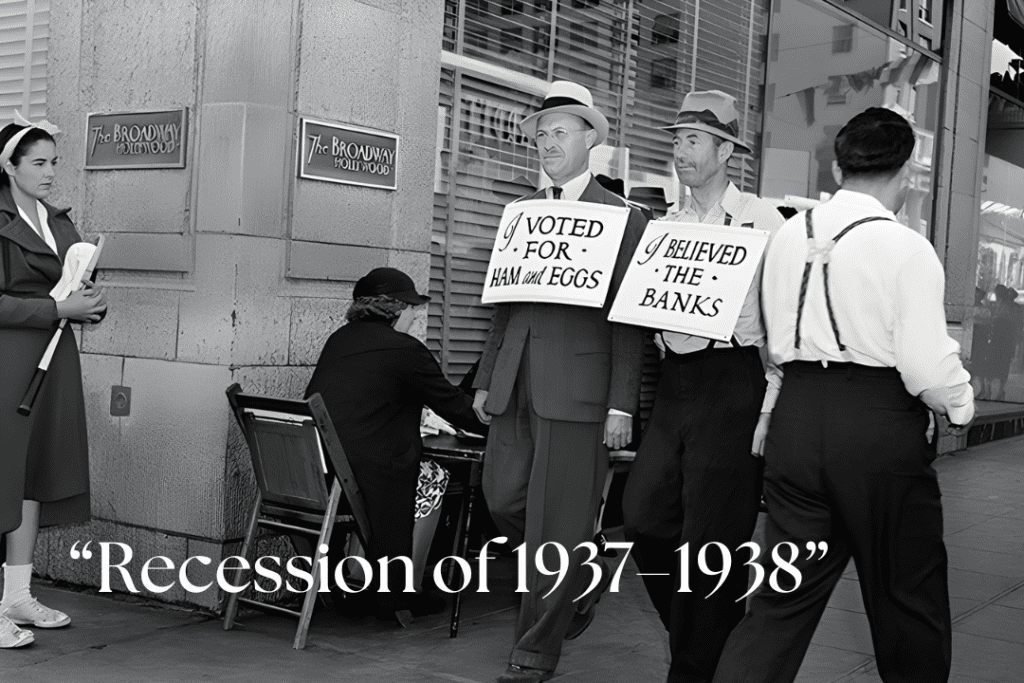

Recession of 1937–1938

Fall Size: This stock market crash Nearly 50%

Causes: Rigid government policies that reduced government spending and raised taxes became the cause of low demand in the economy, which led to massive unemployment.

Recovery: It took 2 years.

Flash Crash of 1962

Fall Size: This stock market crash is close to 22%

Causes: At that time, major companies reported significant losses, which made investors insecure. Also, global political instability made the investors less confident.

Recovery: A few months.

In the year 1961, one of the major stock market crash occurred due to delusion, So what is stock market delusion?

Market Crash 1973–74

Fall Size: Nearly 45%

Causes: At the time of the “Yom Kippur War,” OPEC imposed sanctions on countries that were supporting Israel. This made the price of oil skyrocketing and caused massive inflation. The economic slowdown and inflation at the same time caused excessive stagflation. The biggest moment came when U.S. President Nixon took the gold standard off paper.

Previously, paper money was backed by gold, which simply means the government can’t print without making sure there is adequate gold in the reserve, which is equivalent to the money they are printing, but now the U.S. can print unlimited money they want, which must be followed by the supply and demand of currency. Then we see the Watergate scandal and rising interest by the fed.

Recovery: Nearly 5 years.

Black Monday (1987)

Fall Size: Almost 22% in a day.

Causes: Automated trading programs and portfolio insurance strategies made the cycle of selling in the market. This made the market go panicky, and there was more selling pressure at the time because there were too many global economic concerns.

Recovery: Roughly 2 years.

Dot-com Bubble (2000–2002)

Fall Size: Nearly 78%

Causes: The stock market crash of 2000–2002 was one of the most interesting falls of the U.S. market ever. This was the time when internet companies started getting massive attention.The same thing happened with railroads previously, with excessive overvaluation and funding. There was a lack of profitable and sustainable internet businesses; everyone who used to put “Dot-com” with their company’s name, even if there was no connection with any internet type of thing, used to flourish. This much madness was there. When the bubble burst, most internet companies lost valuation even by 90%, which is insane.

Recovery: Roughly 5 years.

Financial Crisis of 2007–2008

Fall Size: Approximately 54%

Causes: This was one of the most deadly and globally impactful Falls in the U.S. stock market ever. In the case of “Financial Crisis of 2007-2008” there were not multiple reasons but a core reason, which was “Unsecured mortgage loans”. Most banks issued mortgage loans to people whose credit history were extremely poor, many investment firms invested heavily in real-estate market. Banking system has many failures; that’s why all this unsecured loan were processed. Eventually, many loan defaults started and many bank collapsed, including investment firms like “Lehman Brothers.” This caused extreme panic & ultimately one of the deadliest fall in the U.S. stock market.

Recovery: Almost took 6 years.

Flash Crash (2010)

Fall Size: Approximately 9%

Causes: The 2010 flash crash was a completely human and system-based error and failure. There was no economic reason behind it. Because of high-frequency trading algorithms, a massive sell order was executed, which made the price fall.

Recovery: By the end of the day, it was recovered.

COVID-19 Pandemic (2020)

Fall Size: Nearly 34%

Causes: The stock market crash of 2020 was a pure Black Swan event; a Black Swan event is a super unpredictable with severe consequences event. As a consequence of COVID-19, global trade was excessively impacted, which disrupted the supply chain. Unemployment was skyrocketing because many businesses were shut down, although from the stock market perspective, it took less time to recover.

Recovery: By the second half of 2020.

Conclusion

As we have seen many crashes in the biggest economy in the world, we can quantify that boom and bust are a cycle of the economy; it has to happen; it will happen, but the most important thing is that it will grow too. Crashes will happen, and it will recover from them. Always make sure you have opportunity funds parked in secure assets so that you can make a fortune. Fortune is made by putting money at a time when everyone is pulling. I hope this article made your time valuable.

Know the impact of union budget in INDIA

Your blog has helped me become a better version of myself Your words have inspired me to make positive changes in my life